Arjun Rohilla and Dan Blundell of Paragon provide an overview of what to expect when renewing professional indemnity insurance this year

In welcome news for the profession, the spring professional indemnity insurance (PII) renewal season continues to follow the October 2024 period, mirroring healthy premium reductions for many law firms. Paragon’s exclusive facility, LawSelect, has continued to grow and insurers are also demonstrating greater flexibility in considering new clients engaged in higher-risk areas of work, providing these activities are performed with extra diligence.

Key findings

For law firms yet to renew in 2025, there is optimism about the increasing options available for both current and prospective clients. Given the positive market conditions, which are a result of new capacity entering the marketplace, we’re negotiating longer-term policy options with the majority of insurers. We’re also in discussions with several new insurers looking to enter the legal insurance market and anticipate further additional capacity becoming available throughout the year.

Coverage

Key finding in terms of coverage include the following:

- There is greater flexibility from insurers in considering new clients that engage in higher risk activities. If this can be demonstrated in a managed way, with correct risk management and processes in place, these clients have more options than in previous years, creating welcome competition.

- Co-insurance continues to be an attractive proposition for many insurers, allowing the risk to be shared. This allows for a relaxation in traditional underwriting appetites, or alternatively improving on pricing if they were to insure the full primary limit of indemnity .

- At Paragon, we have been able to provide insurer options for firms who have may have suffered significant claims experience deterioration over the past six years.

- Many insurers are improving cover for professional conduct infringements, allowing sub-limits that protect individuals at the firm from Solicitors Disciplinary Tribunal or Solicitor Regulation Authority (SRA) investigations (covering only costs, not fines).

- The legal sector remains a prime target for cyber criminals, due to the sensitive data and funds they handle. Although 65% of law firms have been a victim of a cyber incident, a staggering 35% of firms still do not have a cyber mitigation plan in place. Insurance coverage varies between policies, making it essential to match your firm’s specific needs accurately. This is normally assessed on a case-by-case basis, so please get in touch with your broker to review your coverage and ensure it’s aligned with the most suitable insurer.

Rates

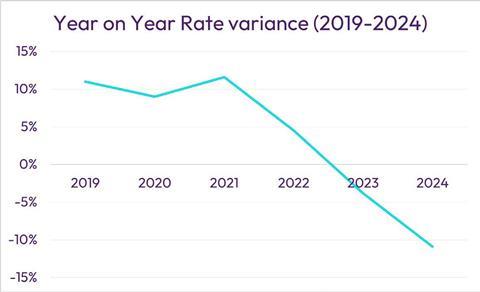

Paragon saw healthy rate reductions of over 10% in April 2025, and our excess layer insurers saw rates reduce to a similar level against the previous year.

A significant proportion of law firms chose to renew for longer-term periods due to the positive market conditions.

Rates are at their most competitive in the past five years.

Time for change?

2025 is an opportune year for law firms to reassess their insurance needs and take advantage of the favourable market conditions. Market cycles can shift quickly, largely affected by geopolitical factors like interest rate fluctuations, catastrophic losses from natural disasters, and political instability across other insurance lines.

Benchmarking

While many law firms focus on their insurance in the lead-up to renewal, most brokers provide accurate premium estimates year-round. Ask if your broker can evaluate deductible (excess) options and recommend whether your practice’s level of cover is appropriate based on your firm’s areas of practice. It’s worth investigating policy reviews for ancillary insurance, as well as conducting annual risk management assessments to support your firm’s ongoing needs.

Risk management services

Proactively staying ahead of SRA investigations is critical, and your broker is there to help your firm maintain full compliance. At Paragon, LawSelect clients benefit from access to our risk management fund, which can be used for third-party risk management services such as regulation 21 audits and anti-money laundering training.

Your broker should meet you to gain a comprehensive understanding of your business. This insight is crucial for effectively communicating your practice’s strengths to insurers during negotiations. While the proposal form provides the data, it’s your broker who tells the story!